Think you’re ready to grow your business? Not so fast. Did you know many businesses fail because they don’t appropriately manage their growth?

Bigger is not always better. I realize this concept sounds counterintuitive. In the business world, we’re used to thinking a bigger business is a better one.

But it’s a mistake to equate size with success.

What does success mean for your business?

First of all, let’s clearly define “success.” From a financial standpoint, the kind of success you should be most concerned with is pretax profitability and cash flow, both short-term and long-term.

So, where does size fit into the profitability formula? The thought is that the bigger you become, the more revenue you can generate. But being bigger also means incurring more costs, which eat away at your profits.

Impacts of a bigger business

Let’s think about your own business. A bigger business will require more equipment, inventory, and personnel than you currently have. Your business will also be hungry for more customers to keep revenue up.

So, how do you know if growth is appropriate for your business and how to best go about it? Fortunately, you don’t have to guess. Your numbers will tell you.

For the numbers I’m talking about, though, you’ll need something a little more complex than the standard profitability formula of sales minus costs. That’s because you’ll want to see how your profitability goes up and down as you incrementally generate more sales and incur more costs.

Use these numbers to help you decide

Let’s review some key terms you should understand. Instead of giving you a list of definitions, I’ll try to illustrate their meaning by discussing them in the context of a hypothetical business.

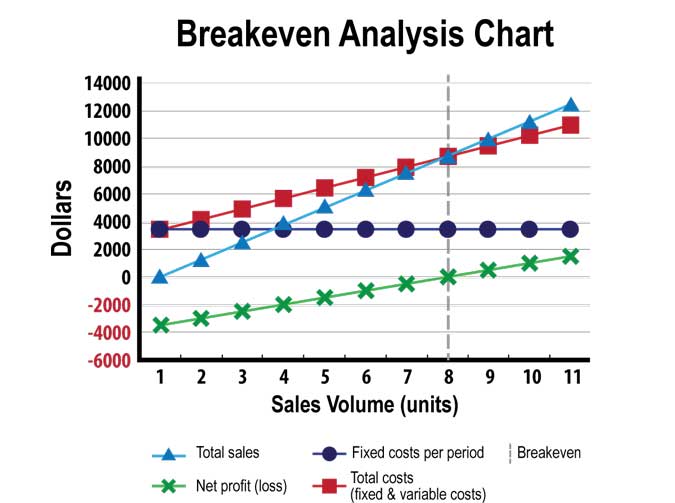

We’ll pretend I own a business. Here is a chart representing some key information during a particular time period:

On the chart, you can see that my sales are going upward. That’s good news.

But, as you’ll notice, the more I sell, the more costs I incur too. That’s because I have to buy more materials, hire additional help, etc. These are known as my variable costs. Since my variable costs don’t remain flat, I think about them as a percentage of my sales.

I also have certain fixed costs too. These costs remain constant no matter how much I’m selling (the mortgage on my building, office supplies, etc.).

When I add up my variable costs and fixed costs, I get my total costs. That’s the line in red.

Next, the point where my sales equal my total costs is known as my breakeven point. That’s the point where I’m no longer operating at a loss anymore. You can also see that’s where my net profit also is no longer a negative number.

There’s just one more term to go over and that is incremental margins. To understand incremental margins, look at the chart one more time. Notice the area from my breakeven point and above. I already have my fixed costs taken care of so these aren’t eating away at my profits any longer. I’m simply spending more in variable costs but I’m also maintaining positive sales growth too. The amounts I’m making here are my incremental margins.

Once I’m getting incremental margins, that’s where my profitability can really pick up steam. That’s because, with my fixed costs taken care of, my incremental margins should be higher than my normal sales margins.

What do your numbers tell you?

If you want to grow your business, you must first know all of these numbers currently and how they relate to one another. What is your current breakeven point? As your sales increase, is the rate of your variable costs going upward, downward, or staying the same? Without this information, you’re simply navigating in the dark.

Plug in different values for these figures so that you can see how exactly your profitability is affected in different growth scenarios. Consider all of the changes that come with growth too. For example, by growing your business, will you have additional fixed costs like a new building? If so, plug them into your chart.

The aha moment: maybe growth isn’t the best strategy right now

When I have my clients sit down to work through these numbers, they almost always have an aha moment that causes them to rethink their current strategies. They realize that growing their businesses is not necessarily the way to becoming more profitable.

My clients then want to know what they can do right now to lower their breakeven point so that they can experience profitability sooner.

How do you do that?

In the next post, we’ll go over tangible ways you can reduce your fixed costs, keep your variable costs at bay, and generate more revenue.

Conclusion

There are a lot of things to consider before pursuing growth. Business growth should be one of your main goals, but be mindful of all the things that come with it. To know if you’re ready to grow, use the information above to help.

For more information on the topics discussed in this article, check out my presentation called Understanding Finance for Non-Financial Leader, which you can read for free.

Hi, I'm KP Persaud...I spent 32 years working as an executive at major companies in the U.S. Now, I help others build better businesses through coaching and training.

Hi, I'm KP Persaud...I spent 32 years working as an executive at major companies in the U.S. Now, I help others build better businesses through coaching and training.