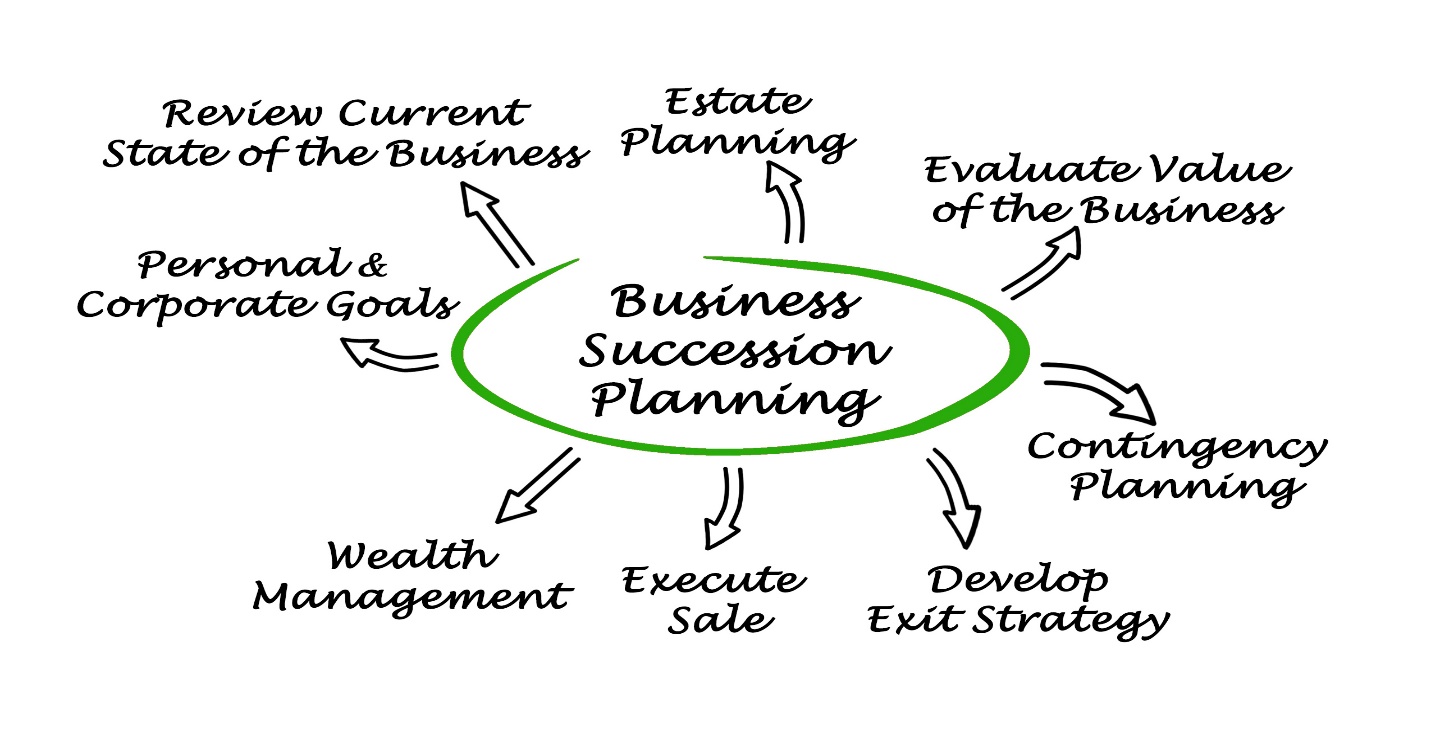

Learn how to fetch the highest price for your business, mitigate risks, and successfully hand over the reins to the new owner.

I have been a Business Coach for 20 years and a Business Executive for 30 years. One of the most challenging experiences I have gone through was planning and executing a succession plan in a family setting.

Here are some of the most important issues you must work through:

- Am I ready to retire and what would I do after retirement?

- If I sell the business, can it work without me? If the answer is “no,” then it will be difficult to sell it.

- What is my business worth? Can I afford to retire?

- Where could I find a suitable buyer? Is the buyer(s) my child(ren) or perhaps an employee?

- What does the financial buyout transaction look like?

- What help do I need and where do I find it?

Below is a more in-depth analysis of the key issues surrounding a well thought out succession plan:

1. Are you ready to retire emotionally: Do you feel ready to walk away from the business and turn it over to someone else? This issue is separate from any financial considerations affecting your decision to retire. What does the next phase of your life look like and are you excited for this journey? This is not an easy decision, but I believe you will know when the time is right.

2. Can you afford to retire? Working with a financial planner to help you translate the vision of the life you want to live in financial terms is very critical. Cash flow requirements to consider are your personal balance sheet, proceeds from the sale of your business, social security benefits, etc. Tax liability and the method of the sale of your business can have huge cash flow implications and must be considered as well.

3. If you left, could the business continue working without you? This could be a serious problem. You can get around this issue by staying with the business after the sale until someone can learn to run it. Finding the right buyer that views your business as a strategic acquisition that will be integrated into another business could be another service option. A third option is to train a General Manager and then sell the business.

4. What is your business worth? There are numerous ways to put a value on your business, but at the end of the day, your business is worth what the buyer is willing to pay. However, there are key performance indicators that will influence the buyer to pay top dollar for your company. A few of those include:

- EBITDA – (Historical): Earnings Before Income Tax, Depreciation and Amortization

- Future Growth Rate

- Net Worth in the Balance Sheet

- Return on Assets

- Capitalization Factor of Your Peer Businesses

5. Who is the buyer? Is he/she a family member and ready to lead the business? If not, you need to prepare for succession. Hire a Business Coach to help you.

Selling to an independent third party that is ready to take over the business and run it successfully would be the easiest.

6. Financing the Deal. A complete cash buyout is the easiest and comes with the least risk. Tax liability from the seller’s standpoint is restricted to capital gains. A promissory note with a competitive interest rate is another way to finance a buyout. This is a more affordable solution and more suited for a family member buyout. Interests become taxable to the seller and the buyer’s tax liability may go up due to taking a distribution to make payments in the promissory note.

7. What help do you need to do the necessary things right? It would depend on your situation but at minimum you will need to seriously consider the following help:

- Get a good Business Coach to help you lay out the plan and serve as the mediator, and to prepare the business for sale in terms of leadership in order to enhance the value of the business.

- Get a good CPA to do the tax planning and business evaluation.

- A good attorney to give you legal advice to structure the deal and minimize the risk.

- A knowledgeable Retirement Planning and Wealth Manager to help you understand your financial needs and to invest wisely for your retirement.

Conclusion

The process of Succession Planning involves a lot of moving parts. Creating a plan to put things in the right sequence is of the utmost importance. Give yourself plenty of time to get it done the right way.

Some of you may be further along than others, but to do it right, all the pieces must be in place. By giving yourself adequate time and following the right plan, you’ll be able to fetch the highest selling price and successfully transition out of your business.

Becoming a Better Supervisor: Part 4 (Set a Standard of Excellence)

Learn about Principle 4 of Becoming a Better Supervisor: Set a Standard of Excellence

Becoming a Better Supervisor: Part 3 (Thought Leadership & Change Management)

Read about Principle 3 of Supervision: Thought Leadership & Change Management.

Becoming a Better Supervisor: Part 2 (Focus & Alignment around Expectations)

Learn about Principle 2 of Supervision: Creating focus and alignment around expectations.

Becoming a Better Supervisor: Part 1 (Influence)

The first principle in becoming a better supervisor of others is learning how to become a person of influence. How can you do that? Learn more.

Becoming a Better Supervisor

How well do you supervise others in the workplace? Whether you’re an executive or a construction foreman, use these valuable tips to improve your supervisory skills.

Want to Sell your Business One Day? Focus on Raising its Value Now.

Imagine the day has finally come for you to sell your business. Maybe you’re ready to retire and move to the beach—or however it is you envision your ideal retirement. How can you be sure you’ll get the most from it?

HAVE A QUESTION OR WANT TO TALK MORE?

Fill out the form and I'll get right back with you.

(319) 721-3175

kp@kppersaud.com

Hi, I'm KP Persaud...I spent 32 years working as an executive at major companies in the U.S. Now, I help others build better businesses through coaching and training.

Hi, I'm KP Persaud...I spent 32 years working as an executive at major companies in the U.S. Now, I help others build better businesses through coaching and training.